Farm & Ranch

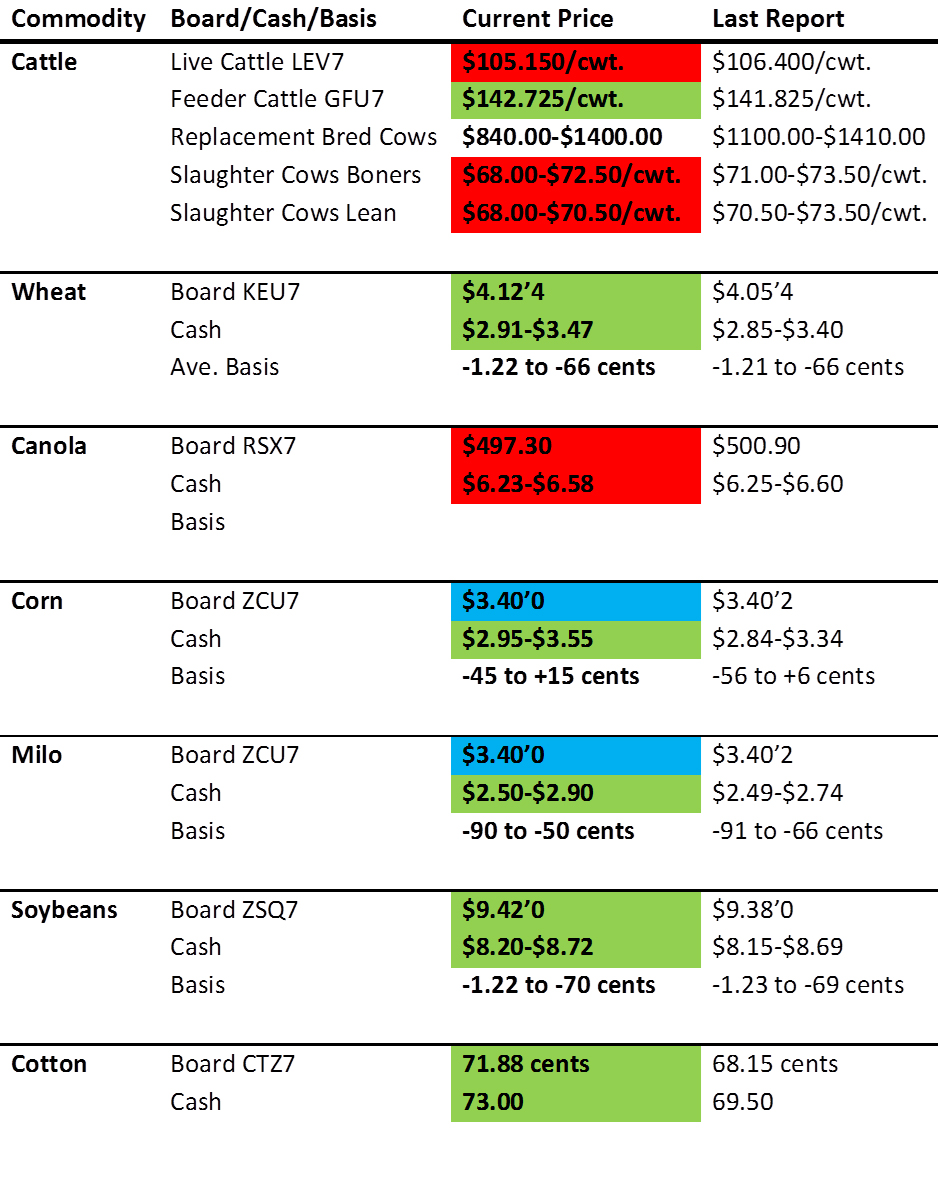

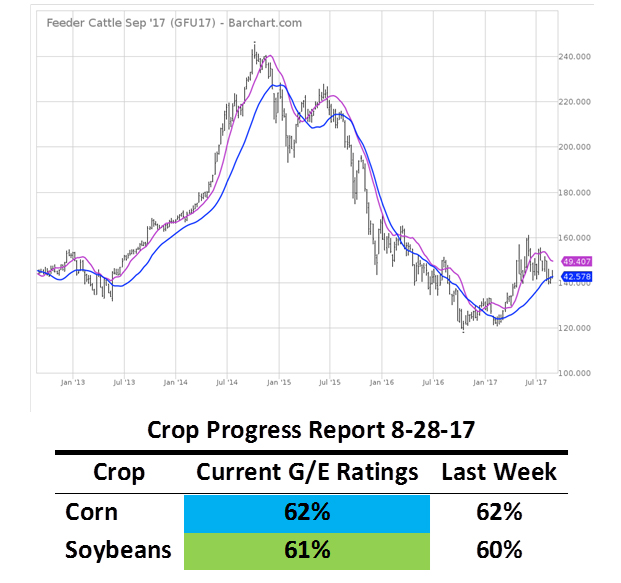

Weekly Market Report: 9/1/17

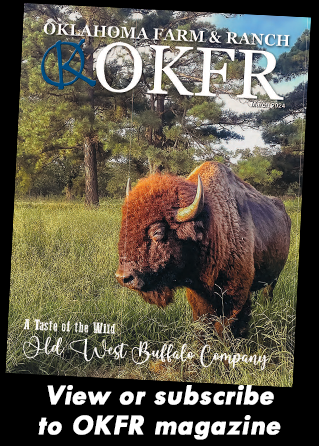

Feeder cattle futures have maintained above the $140/cwt. price level since April. This small rally began in January of ’17 and is showing signs of weakening in recent months.

Large placements of feeder cattle in 2017 will weigh on feeder prices into the first of the year. While there is support at current prices, a large change in fundamentals could push prices below $140/cwt.

Currently, a March ‘18 feeder futures contract costs $139/cwt. If prices fall, the next technical support level will occur at $120-$122/cwt. A producer can purchase a March ’18 feeder cattle futures put option at a $130/cwt. strike price for 5.3 cents per pound.

By using the put option, a 750 lb. calf can be price protected for $40/hd. and the futures sale price would never fall below $130/cwt.

However, prices could still increase if prices rally. In the event that prices fall to $120/cwt., the sale price on the board will be $975/head. Subtracting the cost of the option will result in a net value of $935/head. Alternatively, if prices fall to the next technical support level at $120/cwt., the sale price for a 750lb. animal that is not price protected would be $900/head.

However, prices could still increase if prices rally. In the event that prices fall to $120/cwt., the sale price on the board will be $975/head. Subtracting the cost of the option will result in a net value of $935/head. Alternatively, if prices fall to the next technical support level at $120/cwt., the sale price for a 750lb. animal that is not price protected would be $900/head.

In this example, the producer would increase the futures sale price of the animal by $35/hd. due to purchasing a put option. With the current uncertainty in cattle markets, it will be wise to be cautious.

Farm & Ranch

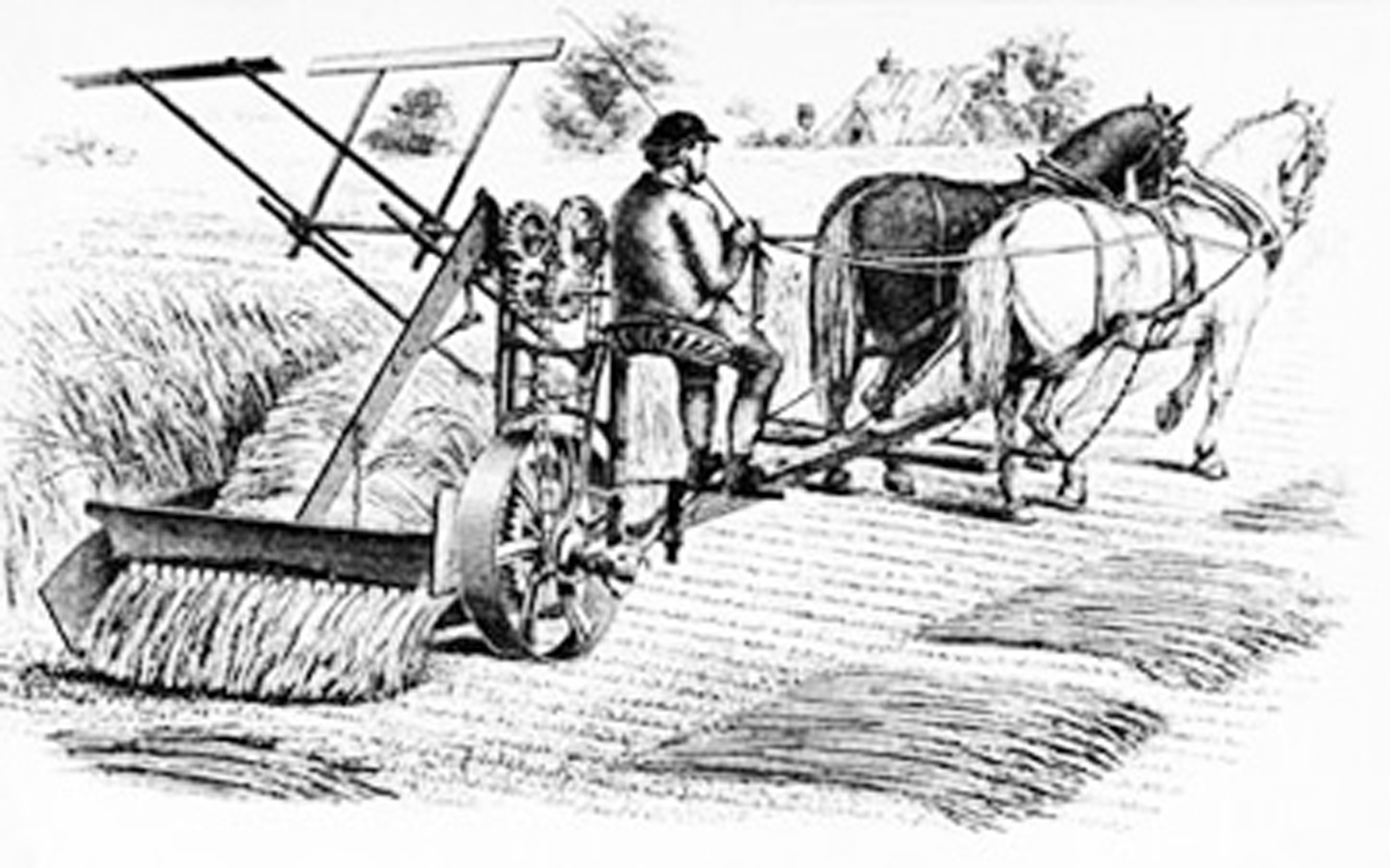

Inventions of Agriculture: The Reaper

Agriculture has been a staple of human society since around 9000 BCE during the Neolithic Era, when humans began developing and cultivating their own food.

For centuries, food production was a slow, tedious process until the invention of agricultural machinery. One such invention was the reaper. Until its time, small grains were harvested by hand, cut with sickles or scythes, hand-raked and tied into sheaves.

While a few had unsuccessfully attempted to create a similar machine, it was Cyrus McCormick who would ultimately be credited with the invention of the first commercially successful reaper in 1831.

McCormick’s invention was a horse-drawn machine used to harvest wheat, a combination between a chariot and a wheelbarrow. He had joined together the earlier harvesting machines into a single, timesaving one. His reaper allowed producers to double their crop size, capable of cutting six acres of oats in just one afternoon. In contrast, it would have taken 12 workers with scythes to do the equivalent in the same amount of time.

McCormick had simply followed in his father’s footsteps. Growing up in Rockbridge County, Virginia, his father had also created several farming implements and even worked to invent a mechanical reaper of his own.

McCormick would patent his invention in July 1834, a year after Obed Hussey had announced the making of a reaper of his own. In 1837, McCormick began manufacturing his machine on his family’s estate.

In 1847, McCormick recognized Chicago as the future of the agricultural machinery industry. The railroad to Galena was nearing completion, the Illinois and Michigan Canal would soon be open, and a telegraph link to the east was coming. So, in 1847, McCormick, together with his partner and future Chicago mayor Charles M. Gray, purchased three lots on the Chicago River and built a factory where they would produce the reaper. It was the first of many industrial companies that would make their way to the area, making Chicago an industrial leader.

McCormick wasn’t done yet. He purchased an additional 130 acres in Chicago in 1871, but the Great Fire of 1871 threatened to destroy his company when the factory burned. It was his young wife, Nettie Fowler McCormick, who pushed the company forward when she went to the site just days after the fire and ordered the rebuilding of the factory. By 1880, McCormick was the largest machinery producer in Chicago and employment reached 7,000, a whopping fifth of the nation’s total.

McCormick joined the companies of Deering and Plano to form the International Harvester Company in 1902. At its height, the company controlled more than 80 percent of grain harvesting equipment in the world. While the Great Depression would hit Chicago’s agricultural industry hard, McCormick’s invention of the reaper forever changed the face of agriculture.

Resources

Carstensen, Fred. (2005) Agricultural Machinery Industry. Encyclopedia of Chicago. Retrieved from http://www.encyclopedia.chicagohistory.org/pages/29.html

Cycrus McCormick, Mechanical Reaper. (2022) The National Inventors Hall of Fame. Retrieved from https://www.invent.org/inductees/cyrus-mccormick

Although the author has made every effort to ensure the information in this article is accurate, this story is meant for informational purposes only and is not a substitute for historical documents.

Farm & Ranch

Scrapie

Barry Whitworth, DVM

Senior Extension Specialist Department of Animal & Food Science Ferguson College of Agriculture

Scrapie is a chronic, progressive disease of the central nervous system that affects sheep and goats. Scrapie is the oldest of the group of neurodegenerative diseases known as transmissible spongiform encephalopathies (TSE). Some of the other TSE are Bovine Spongiform Encephalopathy known as mad cow disease, Chronic Wasting Disease which is found in deer, and Creutzfeldt Jacob Disease which is found in humans. TSE are protein-misfolding diseases that lead to brain damage and are always fatal.

The cause of Scrapie is not completely understood, but evidence indicates that an infectious protein referred to as a prion is responsible for the disease. These infectious prions cause damage to the normal prion proteins found in the brain. The mis-folding of the proteins lead to brain damage and the presentation of clinical signs of the disease. Prions are very resistant to destruction, so once in the environment, they are difficult to remove.

Scrapie is believed to primarily be transmitted by the oral route. Typically, lambs and kids might ingest the prion when they come in contact with the infectious agent through placentas and birthing fluids from infected ewes and does. Older animals may be exposed to the prions this way as well. Colostrum and milk are also sources of prions. Other secretions such as urine, feces, saliva, and nasal secretions may contain infectious prions as well. Once ingested, the prions cross into the lymphoid system. The prions will incubate for a long time usually two to five years before entering the nervous system.

Genetics plays a part in Scrapie infections. Certain breeds are more susceptible to the disease due to genetic composition. Genetic testing is available for producers to help them select breeding stock with resistant genes.

Clinical signs most commonly associated with Scrapie are intense pruritis, ataxia, and wasting. Early in the disease, small ruminant producers may notice slight changes in behavior with sheep and goats infected with Scrapie. Initially, animals may have a staring or fixed gaze, may not respond to herding, and may be aggressive towards objects. As the disease progresses, other clinical signs noticed are progressive weight loss with normal appetite, incoordination, head tremors, and intense pruritis. In the terminal stages, sheep are recumbent and may have blindness, seizures, and an inability to swallow. Once initial clinical signs are notice, death usually occurs in one to six months.

The gold standard for postmortem (dead animals) diagnosing of Scrapie is the use of immunohistochemistry test on brain tissues as well as microscopic examination of brain tissue for characteristic TGE lesions. Live animal diagnosis is possible by testing lymphoid tissues from the third eyelid and rectal mucosa scrapings.

There is no treatment available for Scrapie, so prevention is key to controlling the disease. Following biosecurity protocols is a good starting point for preventing Scrapie. Part of the biosecurity plan is to maintain a closed flock and only buy replacement animals from certified Scrapie free flocks. Producers should limit visitors’ contact with their animals. Sanitation is important in lambing and kidding areas. Manure and bedding contaminated with birthing fluids and placentas should be disposed of properly. Genetically resistant animals should be used for breeding to produce genetically resistant offspring.

It should be noted that there is a novel or atypical form of Scrapie. This disease may also be referred to as Nor98 variant. This atypical version of Scrapie was initially found in Norway. It has been diagnosed in the United States as well. The disease is usually only found in a single old animal in the flock or herd. The brain lesions in atypical Scrapie are different from classical Scrapie. Currently, experts believe that natural transmission of atypical Scrapie is not likely.

The United States Department of Agriculture (USDA) has been battling Scrapie for decades. According to recent information from the USDA, the United States (US) is close to accomplishing eradication of the disease. In order for the United States to achieve Scrapie free status, no sheep or goats can test positive for classical scrapie for seven years and a certain level of testing needs to be done each year that represents the sheep and goat populations within the country. Small ruminant producers can assist the USDA eradication efforts by contacting the USDA when they have an adult sheep or goat exhibiting clinical signs of Scrapie or an adult animal dies or is euthanized. Producers should contact the Oklahoma State Veterinarian, Dr. Rod Hall at 405-522-6141 or the USDA Veterinary Services at 405-254-1797. This will aid the USDA in reaching sampling testing goals. There is no charge for the collection or testing of the samples for scrapie.

Scrapie is a disease that needs to be eliminated from the US. Once eliminated, the US will have additional export markets for sheep and goat products. Oklahoma State University Cooperative Extension Service has an informative fact sheet on Scrapie. Please visit the Local County Extension Office and asked for fact sheet VTMD-9135 or producers may view the fact sheet online at https://extension.okstate.edu/fact-sheets/scrapie.html. Also, the USDA National Scrapie Eradication Program website has valuable information as well at https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/sheep-and-goat-health/national-scrapie-eradication-program.

References Cassmann, E. D., & Greenlee, J. J. (2020). Pathogenesis, detection, and control of scrapie in sheep. American journal of veterinary research, 81(7), 600–614. https://doi.org/10.2460/ajvr.81.7.600

Farm & Ranch

Avian Influenza Update

Barry Whitworth, DVM

Area Food/Animal Quality and Health

Specialist for Eastern Oklahoma

High Path Avian Influenza (HPAI) continues to be a problem in commercial and backyard poultry in the Unites States (US) with over 60 million birds affected. Since the start of the outbreak in 2022, 879 flocks (347 commercial and 532 backyard flocks) have been confirmed with HPAI in the US. Many wild birds and mammals have been affected as well. Five backyard flocks and one commercial flock have been confirmed with HPAI during this outbreak in Oklahoma. The latest was detected in a backyard flock in Carter County on October 16, 2023. For a complete listing of domestic birds, wild birds, and mammals affected by HPAI visit 2022-2023 Detection of High Path Avian Influenza website at https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/avian/avian-influenza/2022-hpai.

Avian influenza (AI) is a highly contagious viral disease. The virus is classified as either Low Path Avian Influenza (LPAI) or HPAI depending on the virulence. This virus infects many food producing birds such as chickens and turkeys while it commonly resides in migratory waterfowl and many other wild birds. Most often ducks, geese, and wild birds harbor the virus in the intestinal tract without having any clinical signs of the disease. The virus is shed in the feces and respiratory secretions from infected birds. Poultry can be infected with the virus when they come in direct contact with infected birds or consume feed that is contaminated with the virus. The virus can be spread indirectly through objects like shoes, clothes, or equipment contaminated with the virus.

Clinical signs of the disease vary depending on the severity of the virus and the organ system affected. LPAI usually results in no clinical signs or only mild problems. However, HPAI has many different clinical signs. Death with no symptoms is a common finding. Respiratory problems such as coughing, sneezing, watery eyes, and nasal discharges may be seen. Depression resulting in loss of appetite and decrease consumption of water may occur. Egg production may be impacted with a decrease in production and/or softshell or misshapen eggs. A bird’s comb, wattle, head, eyelids, and hocks may swell. Combs and wattles may turn purple. Nervous system disorders including tremors, incoordination, and unusual positions of the head may be seen. Diarrhea has been reported in some cases. For more information about clinical signs visit Defend the Flock-Signs of Illness at https://www.aphis.usda.gov/aphis/ourfocus/animalhealth/animal-disease-information/avian/defend-the-flock-program/outbreak-illness/outbreak-illness.

For commercial and backyard poultry flocks, the best defense against HPAI is a sound biosecurity program. Biosecurity is the development and implementation of management procedures intended to reduce or prevent unwanted threats from entering a flock. The protocol is designed to reduce or prevent the spread of unwanted threats through the flock and eliminate any unwanted pathogens that may enter the flock. Lastly, a biosecurity plan is designed to prevent threats from infecting neighboring poultry operations. Biosecurity can be broken down into four basic areas which include traffic, isolation, sanitation, and husbandry.

The first line of defense should be limiting the traffic that enters the area. Poultry operations should have a perimeter buffer area (PBA). For backyard poultry operations, this could be a fence. In commercial operations this may be a fence or road that surrounds the facility. All entry points need to be clearly marked with “Do Not Enter” signs. In a study by United States Department of Agriculture (USDA) evaluating factors associated with introduction of HPAI in layer farms in the US, the presence of a gate was found to be protective against the introduction of the virus. Gates with signage may encourage people to follow biosecurity protocols.

Inside the PBA, a line of separation (LOS) needs to be established. The LOS isolates the birds from possible sources of infections. The LOS is usually the walls of the poultry building plus the entry point. No person should cross this line without following proper biosecurity protocols. Producers should provide visitors with clean coveralls and disposable shoe covers. Visitors should wash their hands before and after visiting the facility. All visitors should dip their shoes in a disinfectant solution when entering and exiting the facility. Also, no other animals, wild or domestic should cross the LOS.

Sanitation is one of the most important parts of a biosecurity plan. All equipment, feeders, waterers, and buildings need to be cleaned and disinfected regularly. First, all fecal material and dirt should be physically removed. Next, disinfectants must be applied and allowed sufficient contact time to work properly. Foot baths need to be properly maintained. The property outside the poultry house should be kept mowed and cleaned. Failure to keep the grass cut and/or to promptly clean up feed spills is associated with HPAI.

Poultry producers must also practice good animal husbandry. Flocks need to be observed several times per day. Producers need to collect and dispose of dead birds frequently. Producer should know the clinical signs of a sick bird. Any unusual increases in sick or dead birds should be reported to proper authorities. Backyard producers have several options. They can contact their veterinarian or Oklahoma State University County Extension office. They can also contact the Oklahoma State Veterinarian at 405-522-6141.

The National Poultry Improvement Plan (NPIP) has guidelines for a biosecurity protocol. Commercial and backyard poultry producers should examine the NPIP 14 standards of the biosecurity protocol. Any areas that do not meet the standards need to be addressed. The NPIP biosecurity audit form can be found at http://www.poultryimprovement.org/documents/AuditForm-2018BiosecurityPrinciples.pdf. Additional sources for backyard poultry producers can be found at the USDA Defend the Flock website at healthybirds.aphis.usda.gov, Protect Your Poultry From Avian Influenza at https://www.aphis.usda.gov/publications/animal_health/bro-protect-poultry-from-ai.pdf or Oklahoma State University fact sheet Small Flock Biosecurity for Prevention of Avian Influenza ANSI-8301.

Avian Influenza is a major threat to the US and Oklahoma poultry industry. It is the responsibility of all commercial and backyard poultry producers to do everything in their power to protect this industry.

Reference

Swayne, D.E. and Halvorson, D.A. 2003 Influenza. In Y. M. Saif (ed.). Diseases of Poultry, 11th ed. Iowa State Press: Ames, Iowa, 135-160.

Green, A. L., Branan, M., Fields, V. L., Patyk, K., Kolar, S. K., Beam, A., Marshall, K., McGuigan, R., Vuolo, M., Freifeld, A., Torchetti, M. K., Lantz, K., & Delgado, A. H. (2023). Investigation of risk factors for introduction of highly pathogenic avian influenza H5N1 virus onto table egg farms in the United States,

2022: a case-control study. Frontiers in veterinary science, 10, 1229008.

-

Country Lifestyle7 years ago

Country Lifestyle7 years agoJuly 2017 Profile: J.W. Hart

-

Outdoors6 years ago

Outdoors6 years agoGrazing Oklahoma: Honey Locust

-

Country Lifestyle2 years ago

Country Lifestyle2 years agoThe Two Sides of Colten Jesse

-

Attractions7 years ago

Attractions7 years ago48 Hours in Atoka Remembered

-

Farm & Ranch5 years ago

Farm & Ranch5 years agoHackberry (Celtis spp.)

-

Outdoors4 years ago

Outdoors4 years agoPecan Production Information: Online Resources for Growers

-

Equine7 years ago

Equine7 years agoUmbilical Hernia

-

Country Lifestyle1 year ago

Country Lifestyle1 year agoSay Yes!